How does the tax on the invoice feature work?

Question:

I have set the tax to 15% in the invoicing feature but it isn’t reflected correctly when I generate an invoice. When the price is 100 the tax came out as 13.04. Shouldn’t it be 15.00?

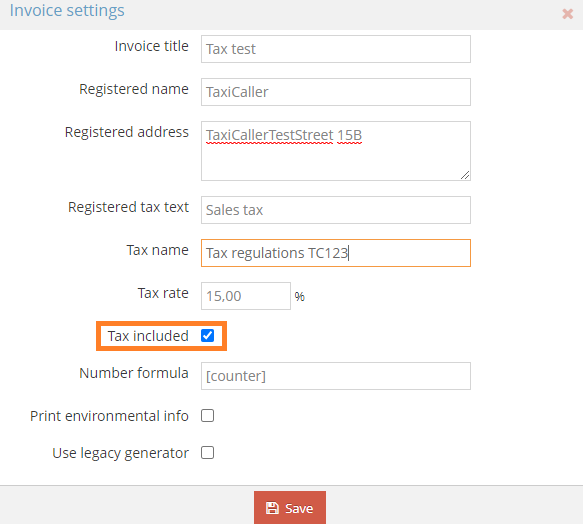

Sales tax included

This is because you have selected “sales tax included” and NOT added. This means you are looking at the total and NOT the subtotal --and asking the system to show you what the subtotal was prior to tax being added, in the report.

Practical example

The cab driver charged the passenger 86.96 from the taximeter. The sales tax in your state is 15%, the state/government takes 13.04 of that the total (86.96 x 1.15 (15%) = ~100.05) –To not have to add this manually every time you do a job the TaxiCaller invoice feature can include the tax for you afterwards.

What the system does when selecting “tax included”; 100.00 including the tax (at 15%) is the total, to find out the subtotal it’s 100 divided by 1.15 (15 being the percentage of your sales tax, if the sales tax was for example 25% it would be divided by 1.25).

100 / 1.15 = ~87, now subtract subtotal from the total (100-87= 13) -the system is more thorough when rounding up or down so it’s 13.04 in the invoice. This means 13.04 was the tax included if the total is 100.00 and the tax 15%, the subtotal was ~87.00.

Good to know

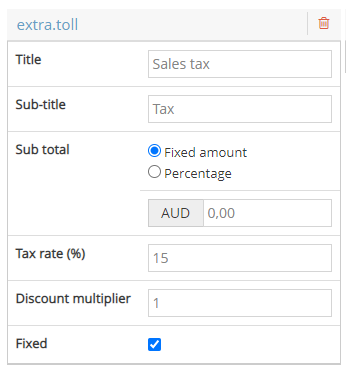

There’s another method of doing this, instead of including tax in the invoice later on if you would prefer to create an extra in the tariff section that you add on manually on every job you can do so here here: https://app.taxicaller.net/dispatch/tariffs